Want TO Make $100K PEr MONTH?

We provide Exclusive Real-Time Leads Nationwide!

✅ Mortgage Leads

✅ Private Money Leads

✅ Hard Money Leads

✅ Real Estate Leads

✅ Loan Officer Leads

✅ Real Estate Agent Leads

✅ Investor Leads

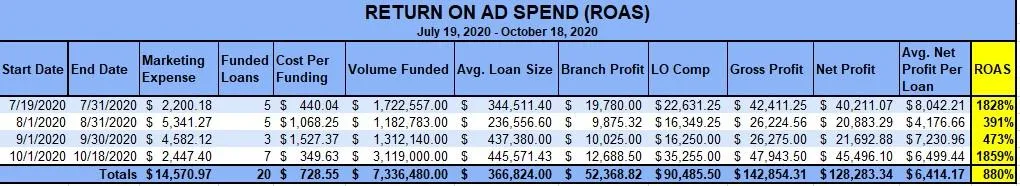

Continue reading to see how we turned $14,500.00 in marketing dollars into $128,000.00 Net Profit.

📲 Tap Learn More to get a FREE copy of our Mortgage and Hard Money Leads Guide! 👇

Watch the above YouTube video to see how our CEO & Founder, Steve Mannenbach, sets up his ad campaigns to generate the highest converting mortgage leads in the United States!

Our leads turn into loan fundings at about a 5-6% conversion rate, assuming you don't have any automated follow-up sequences in place, or telemarketers helping you to contact your leads.

If you have solid sales systems and a CRM, with automated follow-up sequences, Mortgage Loan Originators (MLOs) can expect to close 7-10% of the leads we generate.

Our CEO, Steve Mannenbach, is also a Producing Branch Manager, and he has been ranked in the Top 5 MLOs at loanDepot, EnTrust Funding, and Geneva Financial.

During his first three (3) months at Geneva Financial in 2020, Steve spent $14,570 on Facebook and Instagram advertisements. That ad spend resulted in personal compensation of $90,485 and branch compensation of $85,526.

After subtracting Pricing Exceptions (PEs) of $33,157 and marketing costs of $14,570, Steve was left with branch net profits of $37,798 and MLO compensation of $90,485.

= $37,798 (Branch Net Profit) + $90,485 (MLO comp)

= $128,283 Total Net Profit

As a result, Steve spent $14,570 to generate $128,283 in net profits for both his branch and his personal MLO compensation.

= (Total Net Profit / Ad Spend) * 100

= Return On Ad Spend (ROAS)

($128,283 / $14,570)*100 = 880% ROAS

ROAS is the same thing as Return-On-Investment (ROI) because it allows you to gauge how much profit you made from your ad spend, as a percentage.

880% ROAS is a CRAZY Return-On-Ad-Spend!

If you're not SOLD yet, Steve is going to show you actual screen shots from his Facebook ad account and actual deposits into his bank account from Geneva Financial.

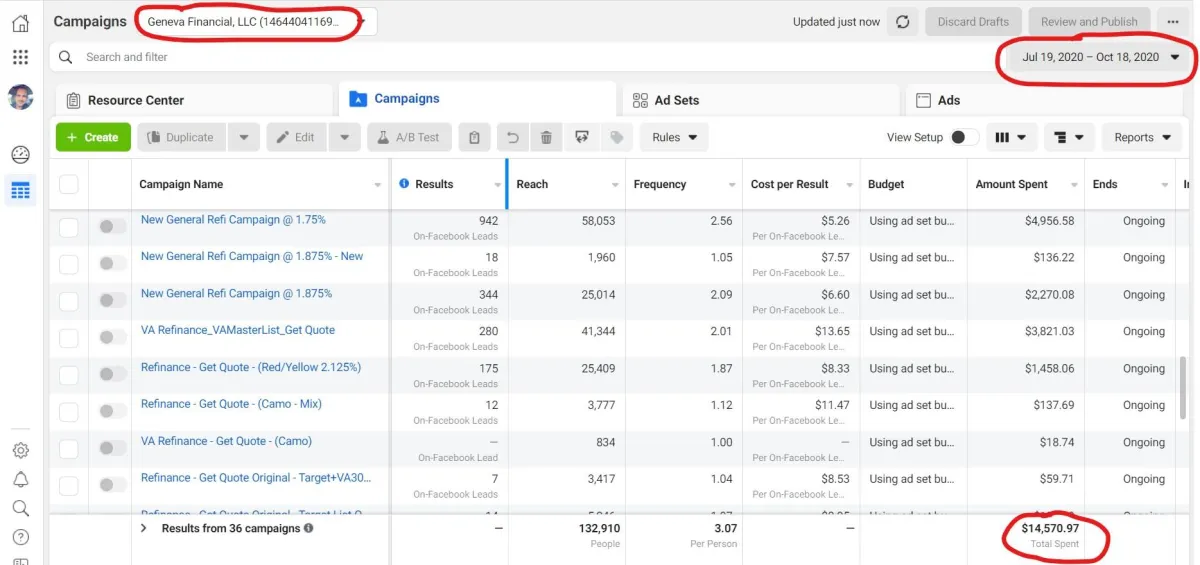

This first image below of his Geneva Financial Facebook ad account, shows the dates of July 19, 2020 to October 18, 2020, which were his first 3-months at Geneva Financial.

You can see the number of leads Steve generated (2030 leads), the Cost-Per-Lead (CPL), and his total ad spend from that period ($14,570).

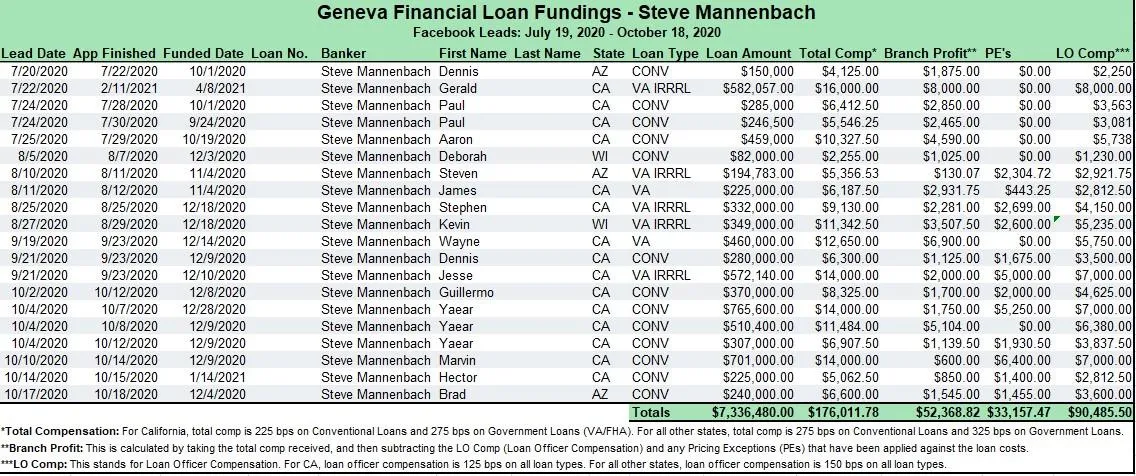

The next image shows a list of Steve's actual loan fundings, from the leads he generated, between July 19, 2020 and October 18, 2020.

He spent an entire day going back through Encompass, the Loan Origination Software (LOS), to tally up when he input a lead's information into Encompass to provide a quote, when he completed an application, and which leads ended up as funded loans.

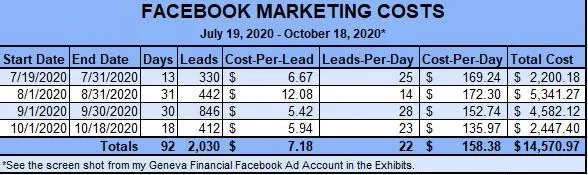

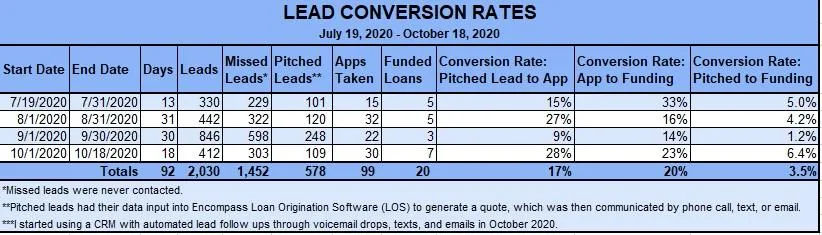

The following images show Steve's marketing costs on Facebook and Instagram, lead conversion rates, and the Return-On-Ad-Spend (ROAS), during this same period.

The key metrics to pay attention to are the Cost-Per-Lead (CPL), the conversion rates from pitched lead to funding, and the Return-On-Ad-Spend.

He averaged a CPL of only $7.18 during those 3-months, his highest conversion rate of 6.4% came in October, and his highest ROAS of 1,859% came in that same month, which coincided with the beginning of his use of a CRM that allows users to create follow-up automations.

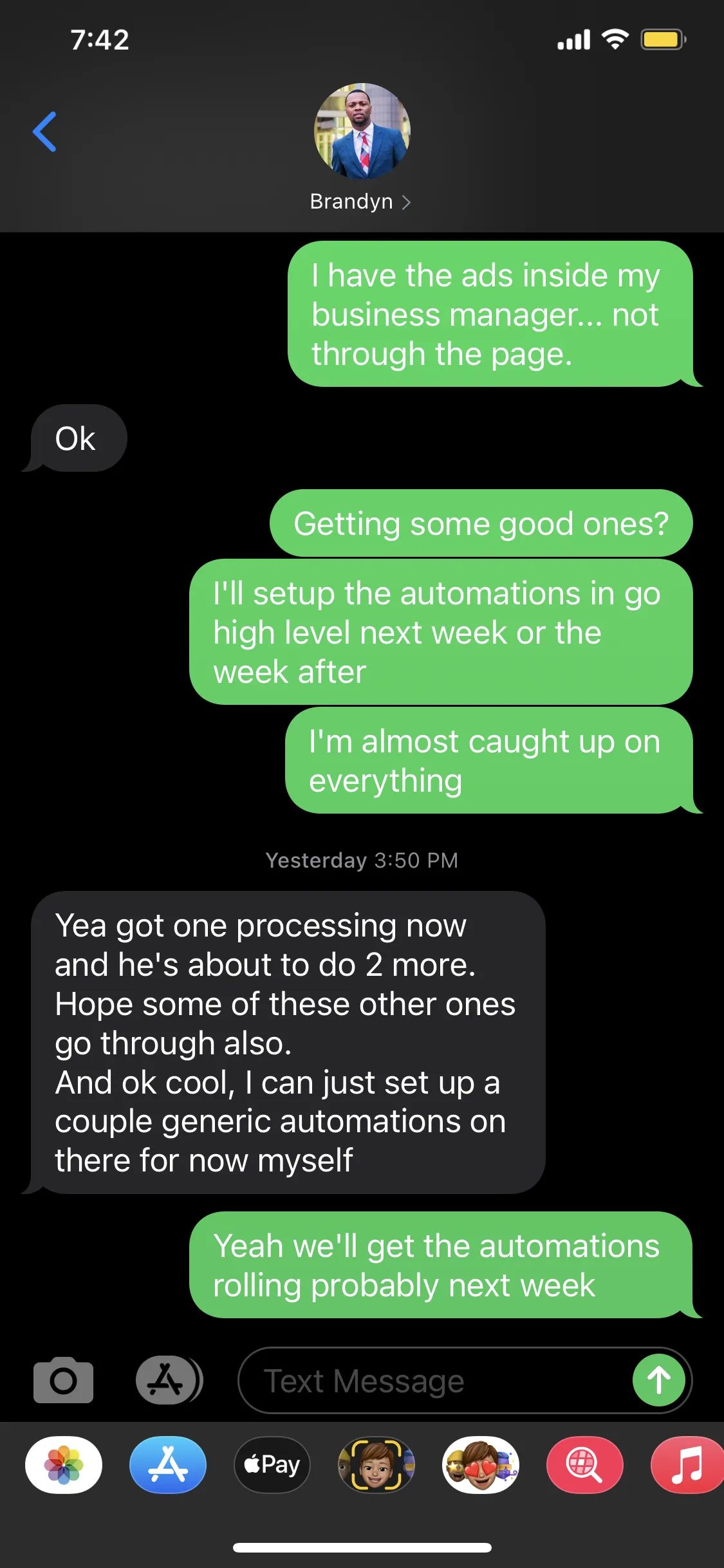

At that time, Steve setup a follow-up sequence utilizing voicemail drops, texts, and emails, in order to push leads to complete the online application (1003), before even speaking with him.

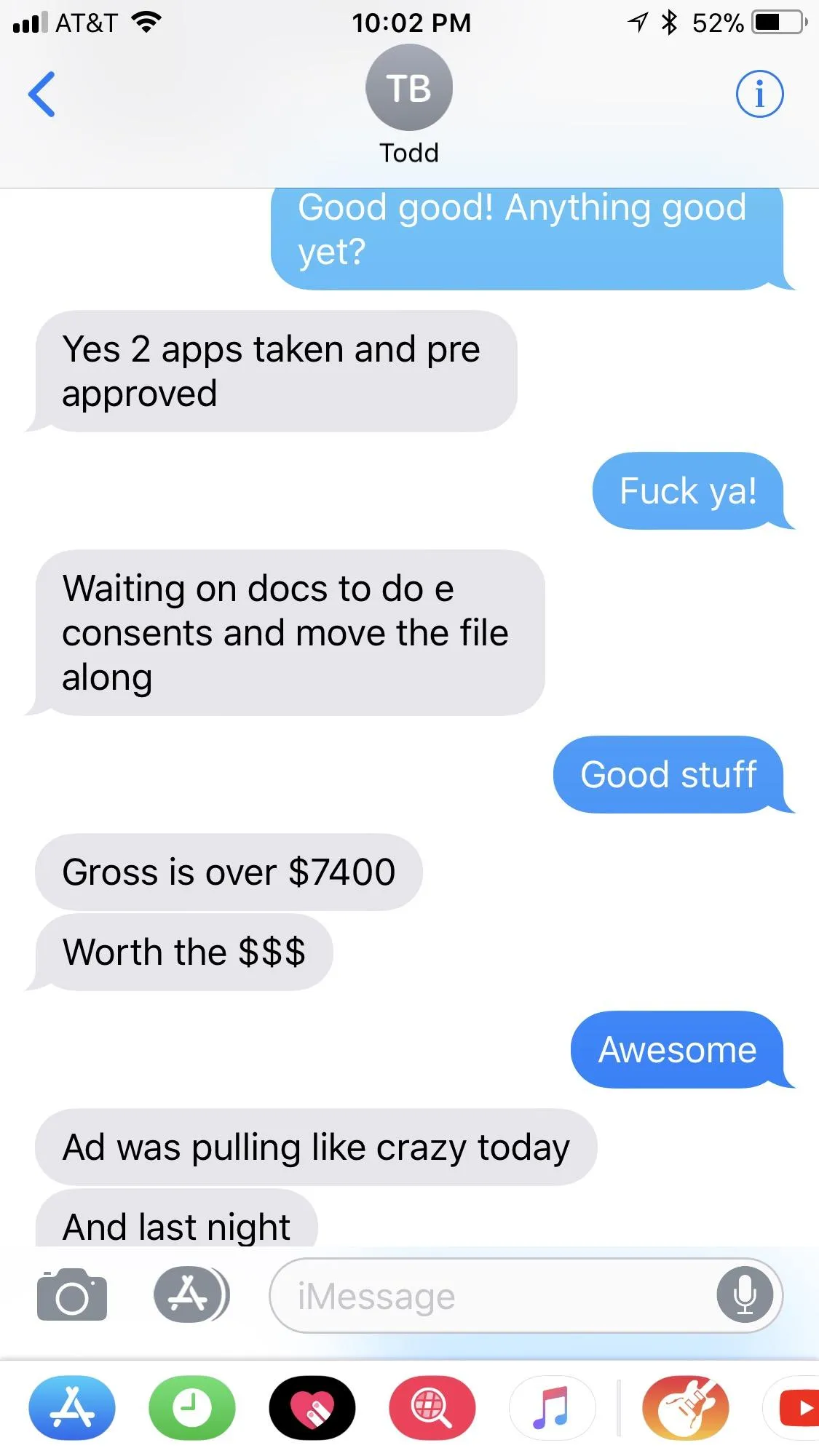

Once Steve started using an automated follow-up sequence, he began receiving anywhere from 2-6 completed loan applications per day.

That is what led to the higher conversion rate in that month.

As you can see, Steve's Facebook and Instagram advertising strategies have netted him HUGE profits!

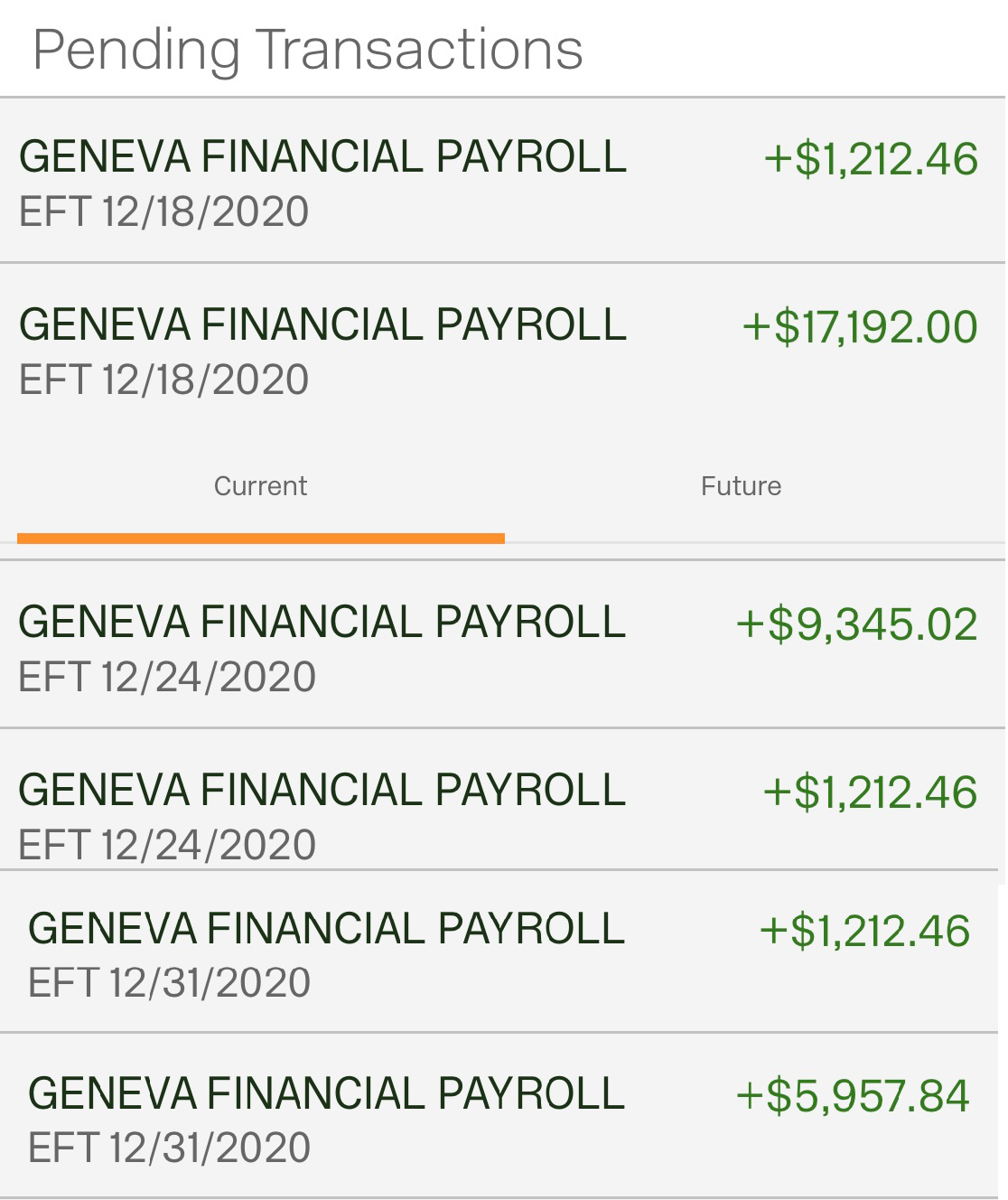

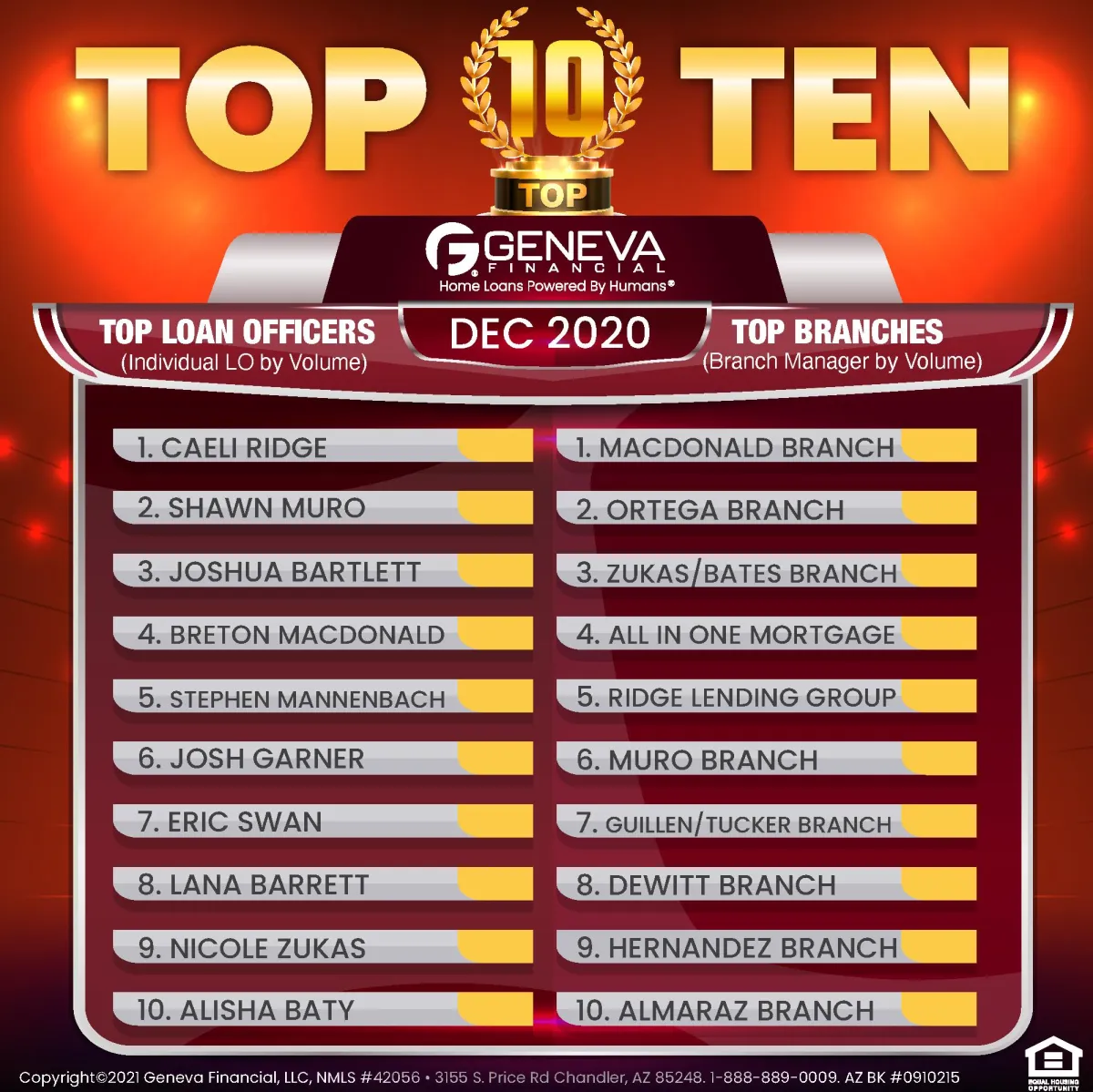

To provide further proof, you can view his direct deposits from Geneva Financial in December 2020, and an official graphic, released by Geneva Financial, showing its Top 10 MLO's in the United States for that month.

In a matter of ONLY 2 weeks in December 2020, Steve received $36,132.24 in after tax income, from Geneva Financial.

ALL of that income was a result of his Facebook and Instagram advertising efforts that occurred during his first 3-months of joining the company.

Steve was then ranked in the Top 5 Best MLOs in the United States for that month, which you can also see below.

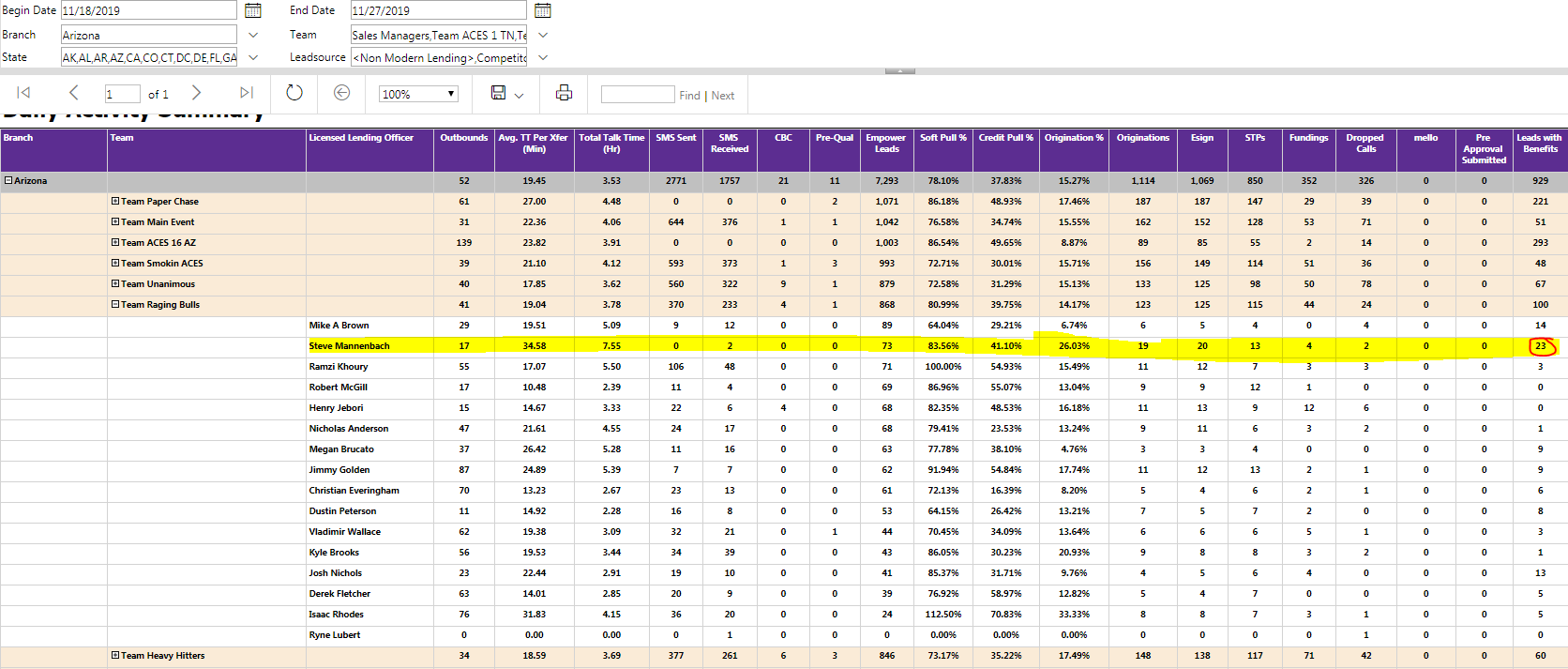

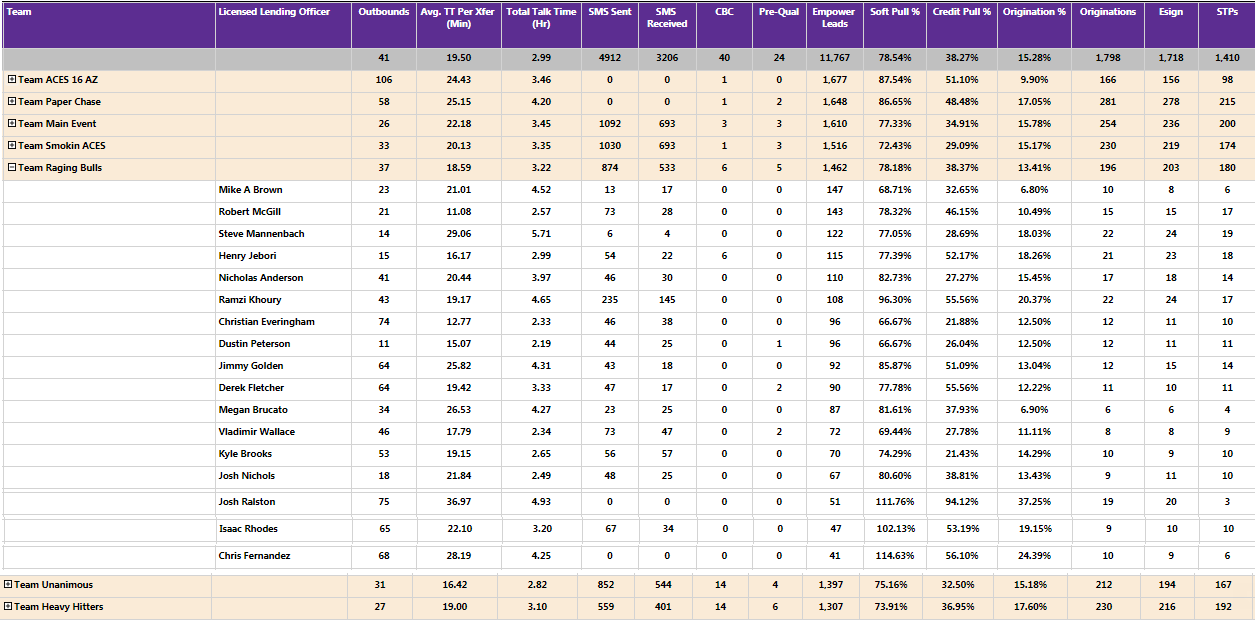

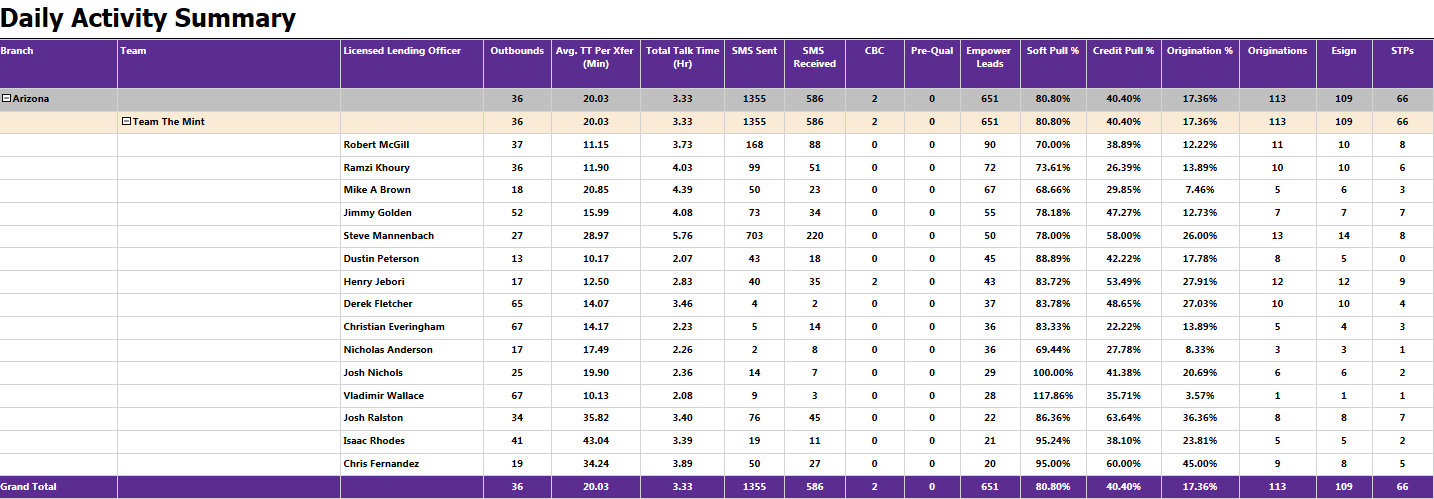

To show consistency, Steve is also posting his stat lines from EnTrust Funding and loanDepot, where he was also ranked in the Top 5 MLOs, before joining Geneva Financial.

Steve has been in the online marketing industry since 2008, and he's been solely focused on Mortgage Leads, Hard Money Leads, and Private Money Leads since 2016.

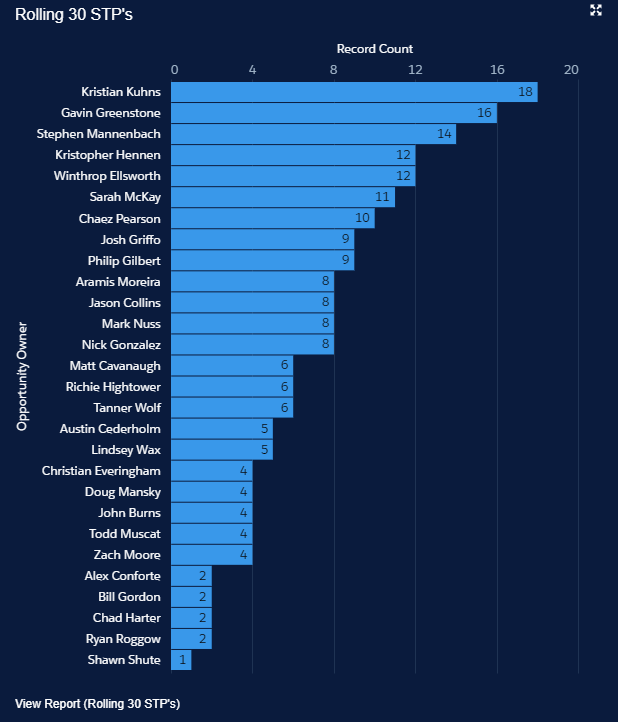

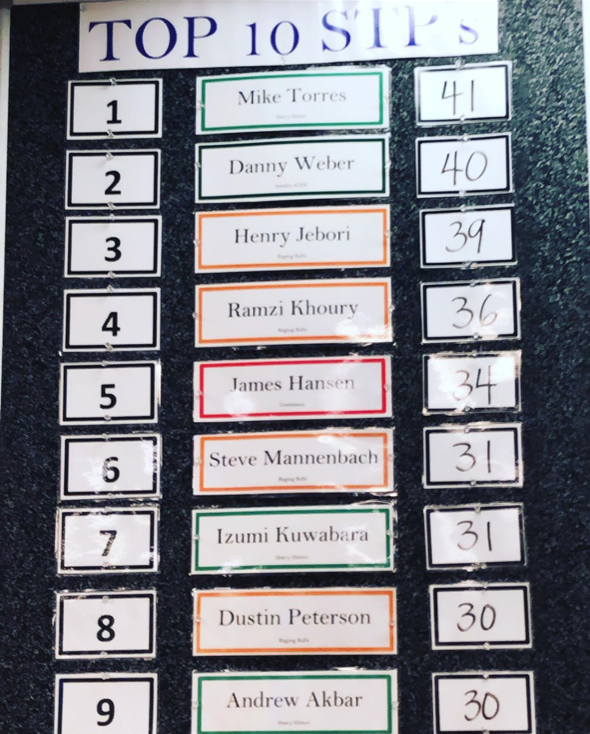

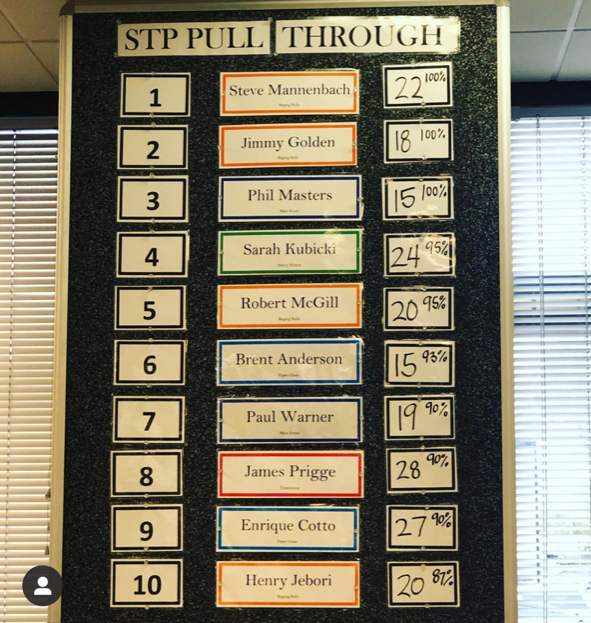

The image below shows Steve hitting the Top 3 MLOs at EnTrust Funding for STPs after only his first month of originating loans, for that brokerage, in Scottsdale, Arizona.

The images after the EnTrust Funding rankings, show his loanDepot call center numbers (e.g. talk time, talk time per transfer, SMS messages sent and received, Originations, STPs, etc.), and then there are a two pictures of when he had his name up on the wall for STPs and STP Pull Through at loanDepot.

If you're ready to take your MLO game to the next level, tap the button below to "Get More Fundings!"

Still not SOLD yet on our Mortgage, Hard Money, and Private Money Leads?

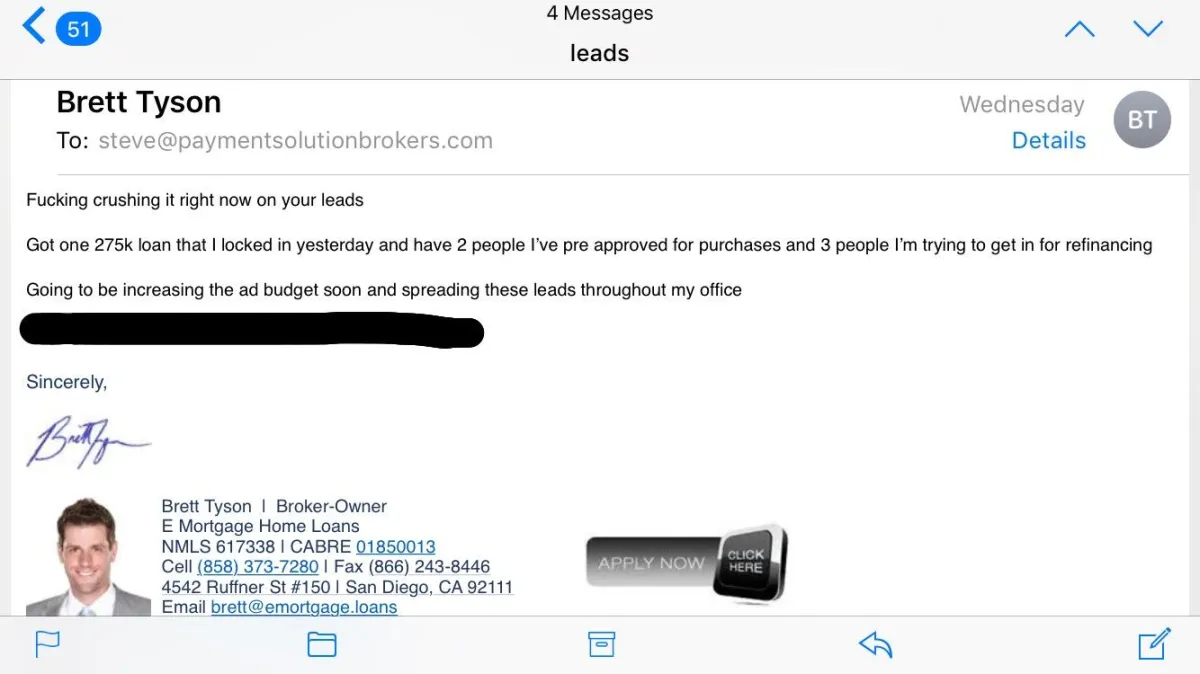

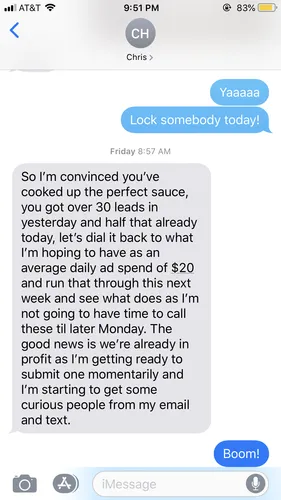

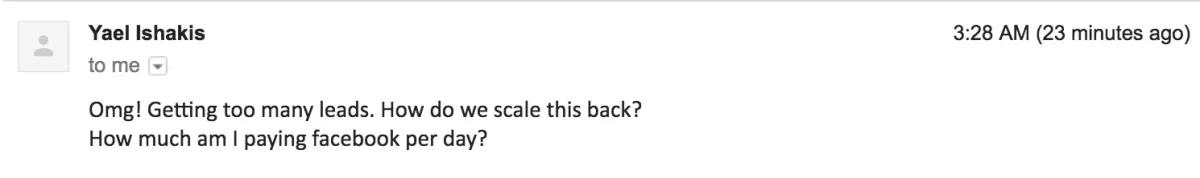

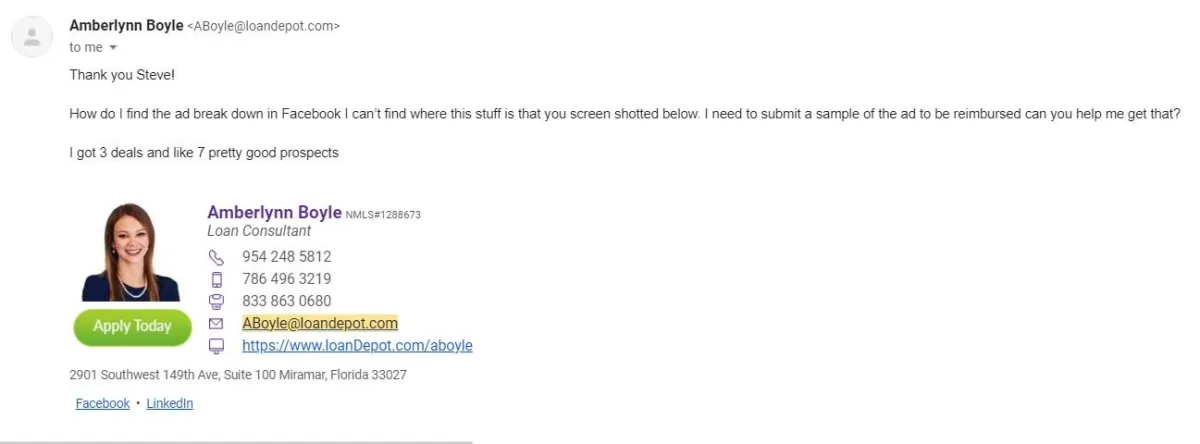

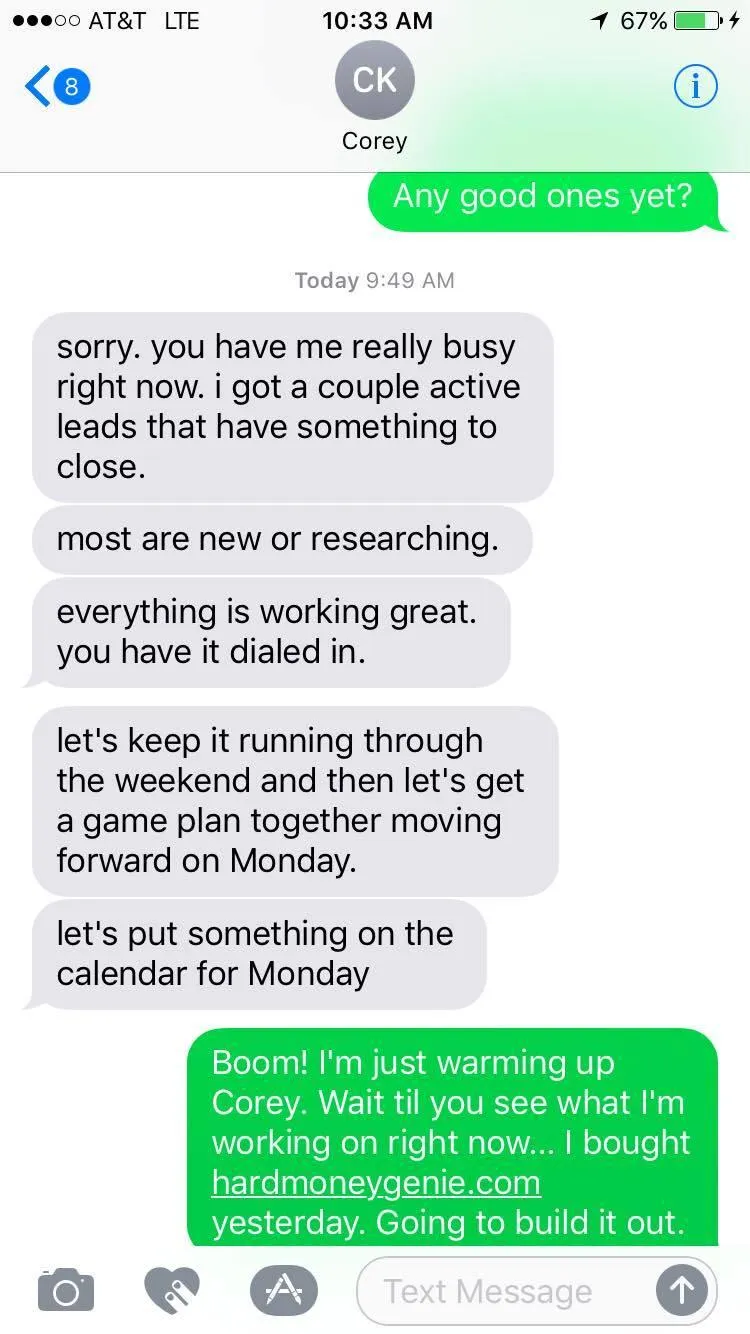

Let's check out what some of our clients have had to say...

We've worked with over 100 MLOs, Brokers, Branch Managers, Hard Money Lenders, and Private Money Lenders nationwide, employed by the following lending companies:

- All State Lending Group

- Allied First Bank

- American Financial Network

- American Pacific Mortgage

- Americas Funding Group

- Bank of England Mortgage

- Bay Equity Home Loans

- BlueWorld Private Capital

- BN Loans

- BOK Financial

- Build Equity Group

- Cali Home Lending

- Castle & Cooke Mortgage

- Cherry Creek Mortgage

- CitiBank

- Civic Financial Services

- Convoy Home Loans

- CountryFirst Mortgage

- CrossCountry Mortgage

- Different Mortgage

- Direct Lending Group

- E Mortgage Home Loans

- Encompass Lending Group

- Fairway Independent Mortgage

- First Capital Trust Deeds

- Florida Mortgage Comm. Int'l.

- FM Home Loans

- Geneva Financial

- Hard Money Bankers

- HomeFirst Mortgage Corp.

- ICG10 Capital

- iFund International

- Innovative Mortgage Services

- Layla Capital

- LBC Capital

- LoanDepot

- Loan Fund LA

- Manhattan Mortgage

- Merchants Lending Group

- NuHome Financial

- Pelorus Equity Group

- Plentura Financial

- PNC Bank

- Private Funds Direct

- PRMG

- Reliance Bay Funding

- Reverse Lending Solutions

- South Pacific Mortgage

- Stonecrest Financial

- Sunstreet Mortgage

- T&M Commercial Funding

- The Flipping Network

- Triumph Capital Partners

- Veterans Home Finance

- Watermark Home Loans

- West Coast Mortgage Group

- Western National Mortgage

Every year our leads get better and better because we continually refine the leads lists (.csv files) that we upload into Facebook to target your ideal borrower audience--e.g. Veterans, Real Estate Investors, Commercial Property Investors, Borrowers looking for Cash Out, etc.

By using these borrower lists to create "Special Ad Audiences" (formerly known as "Lookalike Audiences"), we are able to place our ads in front of qualified borrowers with large loan amounts.

Most lead generation companies will flip you aged leads that have been sold to 4-5 other companies, or use the menu targeting options on Facebook, to try to get high quality leads.

That's why most leads are garbage!

Steve started as a mortgage and hard money lead generator, and then became a top producing MLO and Branch Manager.

He's seen both the marketing and sales side to the mortgage and investment property lending industries.

By actually calling his own leads and sorting leads lists with full borrower data, Steve has been able to cook up the special sauce needed to generate leads that convert at a 5-6%.

The majority of other lead generation companies only do leads, and that's what sets us apart.

Our CEO and Founder, has meshed together the marketing and sales sides of both the Mortgage and Hard Money/Private Money industries.

We are now the #1 provider of Mortgage, Hard Money, and Private Money Leads, in the United States.

Click "Get More Fundings" below to consult with Steve, or one of our other qualified lead specialists, about setting up a custom tailored ad campaign to fit your needs.